Performance results

03

3.1

Business climate

UTLC ERA maintains ongoing cooperation with the following federal executive bodies of the Russian Federation

-

The Ministry of Transport

-

the Ministry of Finance

-

The Ministry of Economic Development

-

The Federal Customs Service

This aims to create a positive business environment for the Company as a whole, as well as to establish legal frameworks that support the main operational goal: increasing freight volumes on the China‑Europe‑China corridor and in Russia/Belarus‑China export and import operations.

Organizations involving participation of UTLC ERA representatives

Advisory committees and expert working groups under the EAEU’s supranational body, the ECE

-

The Advisory Committee on Transport and Infrastructure

-

The Advisory Committee on Customs Legislation and Law Enforcement

-

Subcommittees on Railway Transport, Logistics, and Infrastructure

-

The Working Group on Advance Notification

Working and advisory bodies on transport under international organizations

-

United Nations Economic Commission for Europe (UNECE)

-

United Nations Economic and Social Commission for Asia and the Pacific (UN ESCAP)

-

Organization for Cooperation between Railways (OSJD)

-

International Union of Railways (UIC)

-

Universal Postal Union (UPU)

-

International Coordinating Council on

Trans-Eurasian Transportation (CCTT)i -

and others—including groups like WP.24, SC.2, WP.5

Business associations

-

Russian Union of Industrialists and Entrepreneurs (RSPP): the Committee on Integration, Trade, Customs Policy and WTO Issues; the RSPP Integration Council for Relations with the EEC; the Committee for International Cooperation; and the “Export of Goods and Services” expert group

-

Russian Chamber of Commerce and Industry (CCI Russia): Council for Customs Policy

-

Association of National Freight Forwarders of the Republic of Kazakhstan (ANFK)

-

Eurasian Union of Railway Freight Transportation Participants (EUT)

i

-

Digital Transport and Logistics Association (ACTL)

i

-

Joint Working Group of JSC Russian Railways and JSC NC "KTZ" on Strategic Cooperation (JWG)

Consequently, the promotion of legal initiatives in 2024 has led to the implementation (or ongoing execution) of the following major projects:

Advocating for the Company’s interests on issues of concern — especially in relation to the new chapter "Special Procedures and Conditions for Moving Containers Across the Union Customs Border" — in the draft of the first protocol amending the EAEU Customs Code, which is now being reviewed and approved by EAEU member states.

Federal Law No. 92-FZ dated April 22, 2024, "On Amendments to Articles 164 and 165 of Part Two of the Tax Code of the Russian Federation" introduced changes designed to remove the requirement for taxpayers to submit paper copies of customs declarations and/or shipping, transport, or other documents with customs stamps to the tax authorities when confirming eligibility for the application of the 0% VAT rate on goods or services related to imports by rail. The amendments become effective on April 1, 2025.

Collaboration with the developer of the "TEZ Customs" information system (Republic of Kazakhstan) on efforts to broaden the use of the electronic customs transit procedure by the customs authorities of Russia, Belarus, and Kazakhstan, together with their respective national rail companies. The procedure is currently being tested by the customs services of the EAEU as per Decision No. 41/14 of the Joint Board of Customs Services of the Customs Union, dated April 7, 2023.

Participation in the preparation of the concept of the national digital transport and logistics platform of the Russian Federation — a digital ecosystem to ensure the development of the transport and logistics complex through the introduction of unified standards and services of electronic interaction and the formation of a single digital space for all participants in the transport and logistics services market, ensuring increased reliability, efficiency, speed and safety of freight transportation by all transport modes.

The Federal Customs Service of Russia has incorporated the Company’s perspective in its approach to the seizure of goods— as a precautionary measure in administrative cases pursuant to Part 3, Article 16.1 of the Administrative Offenses Code.

The Company participated in the deliberations at the State Duma of the Russian Federation (Seventh Convocation) on proposed amendments to Draft Federal Law

No. 682527-8 "On Amendments to the Federal Law ‘On Freight Forwarding Activities’".

3.2

Operating results

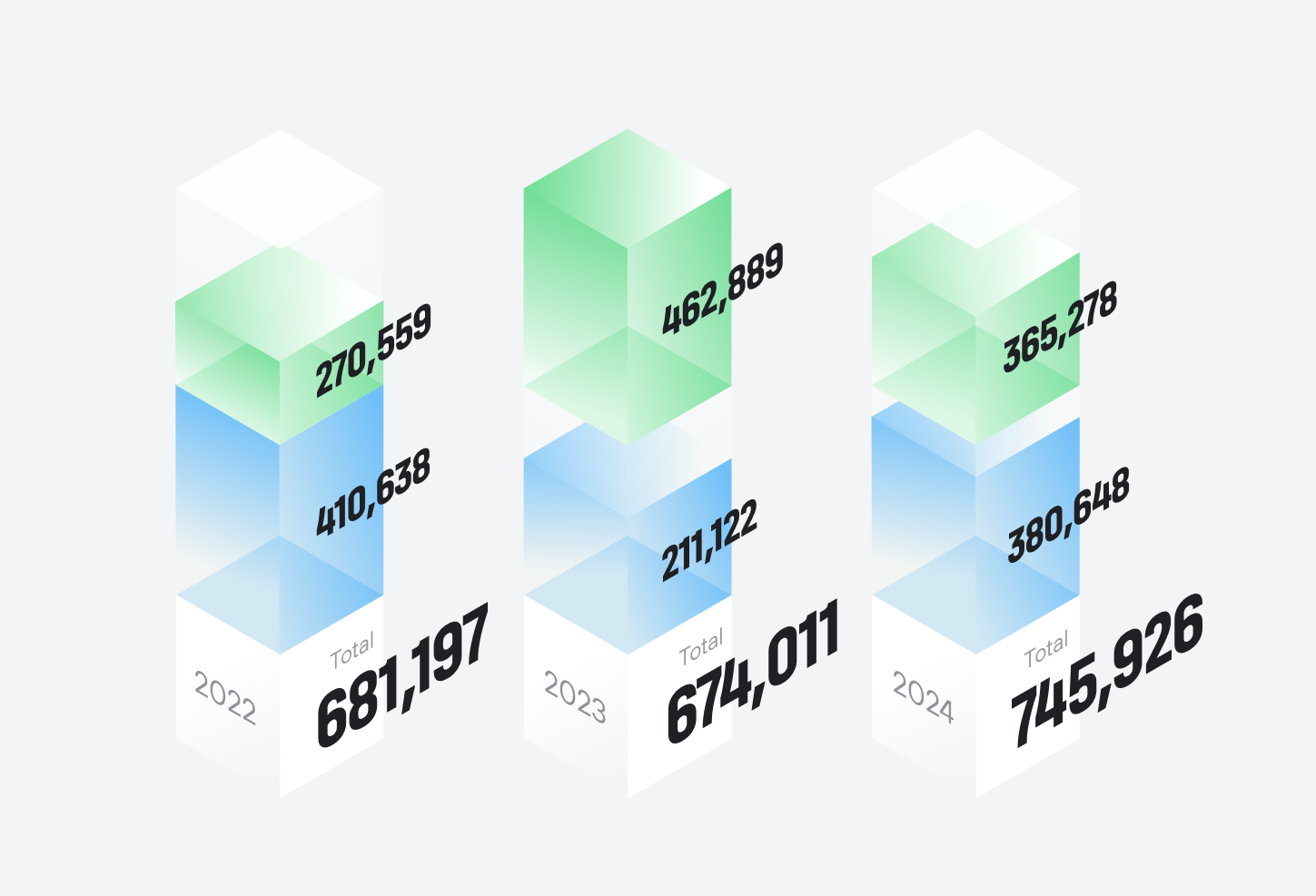

In 2024, UTLC ERA introduced a container transit service in the territories of the Republic of Kazakhstan, the Russian Federation, and the Republic of Belarus.

745,926

TEU

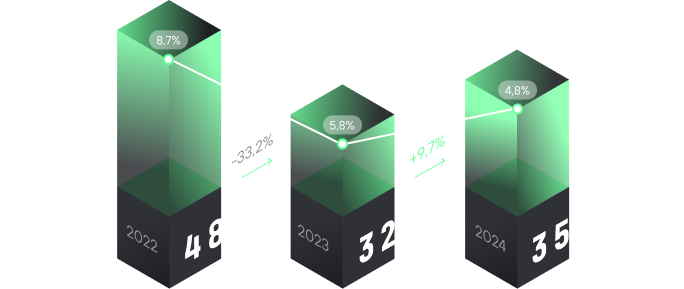

Dynamics of UTLC ERA service volume,

TEU

Net transit

Other transportation

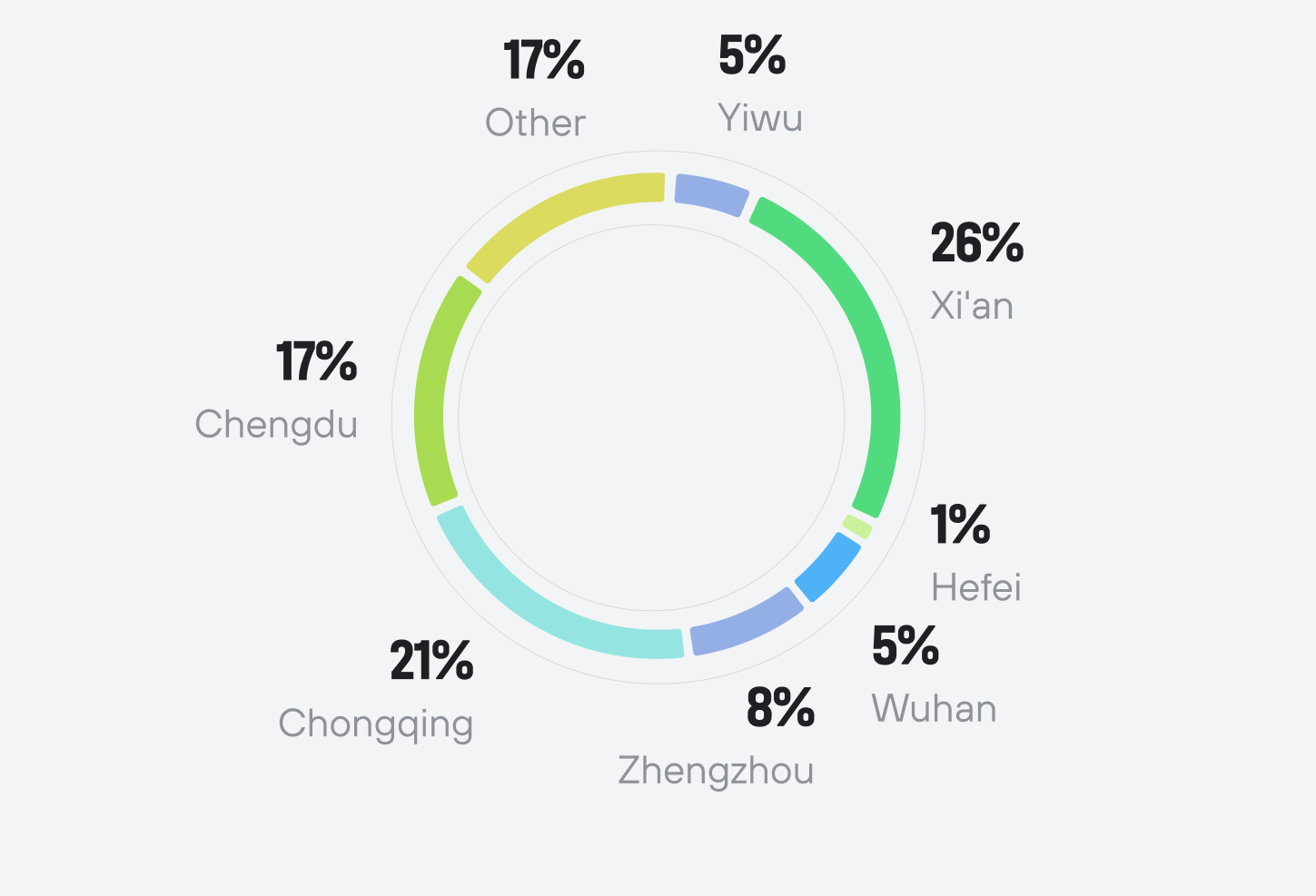

Share of China's provinces in the transportation structure in 2024,

%

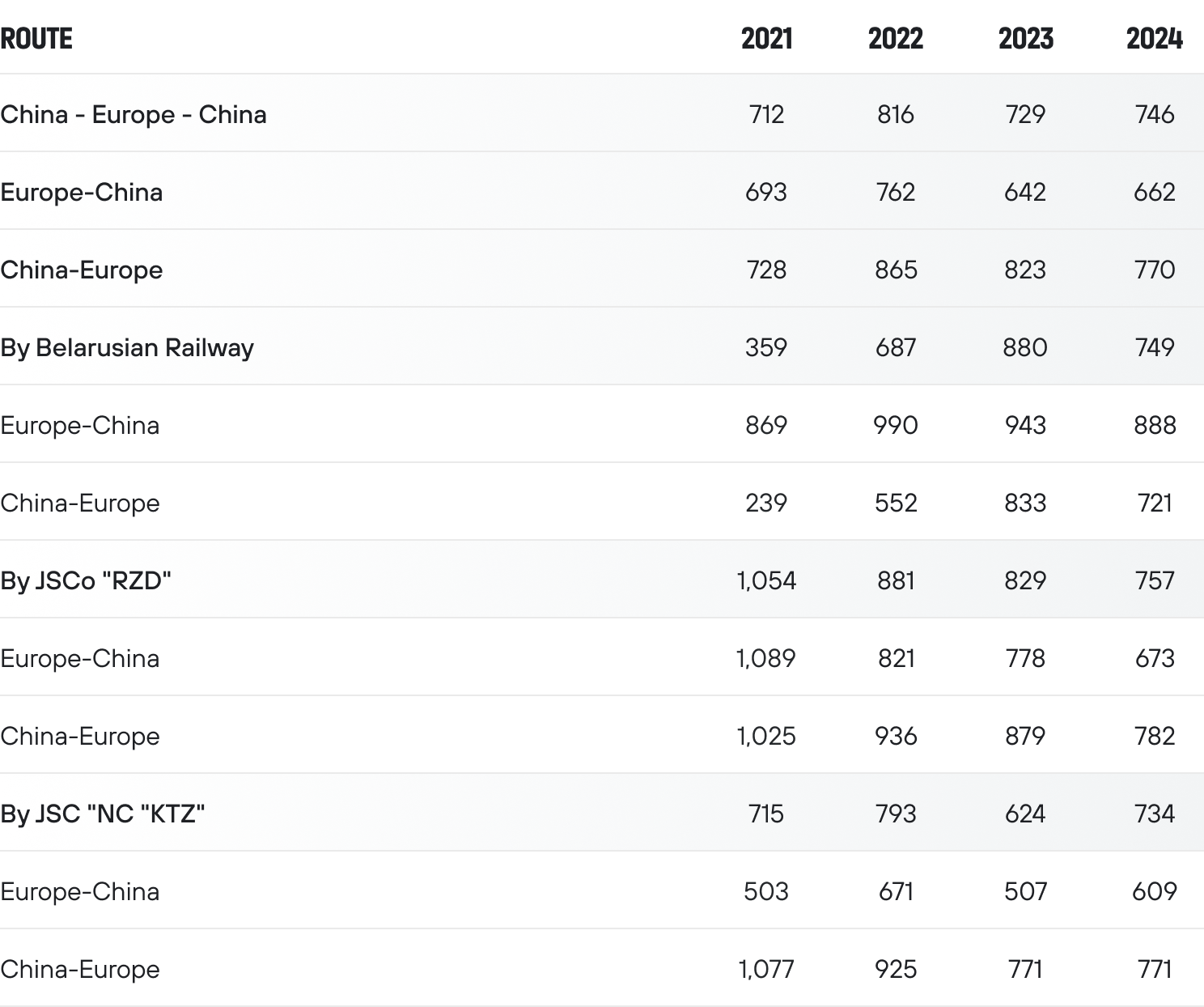

Route speed

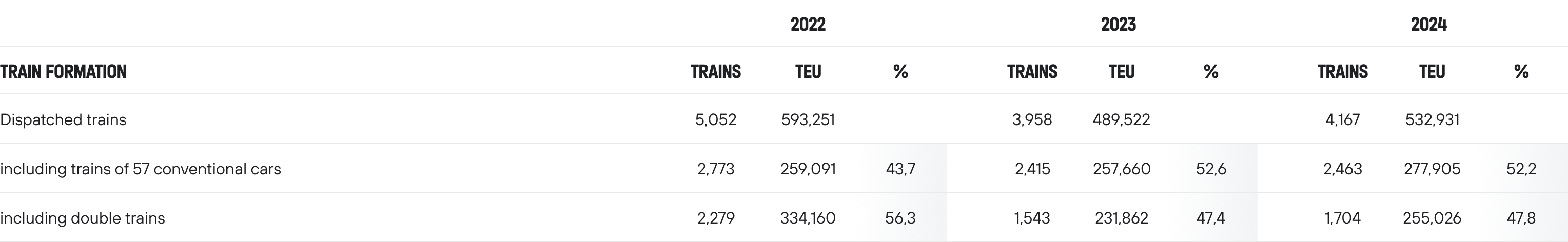

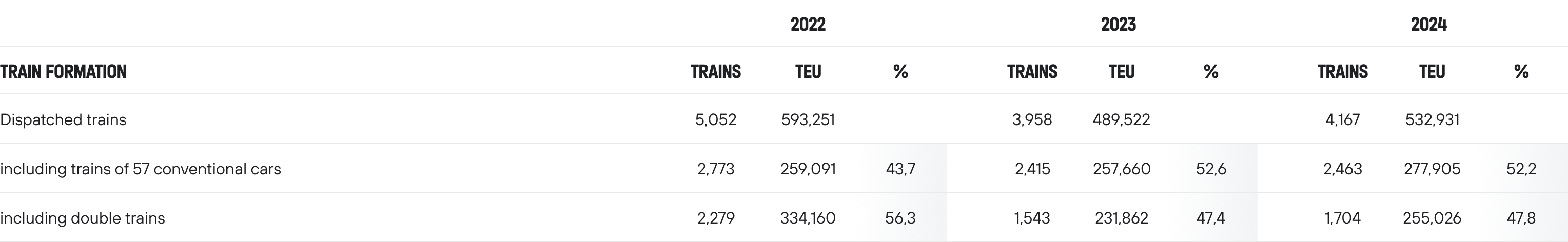

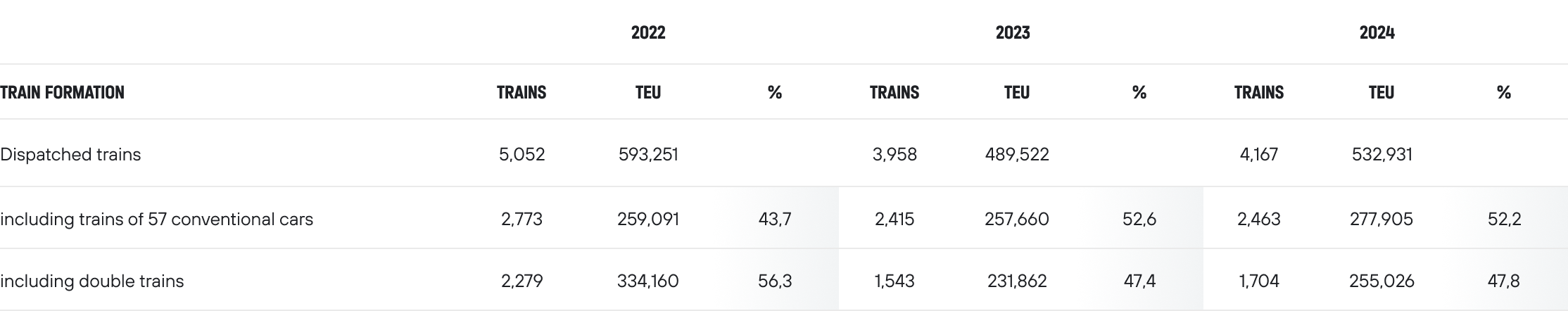

and train formation

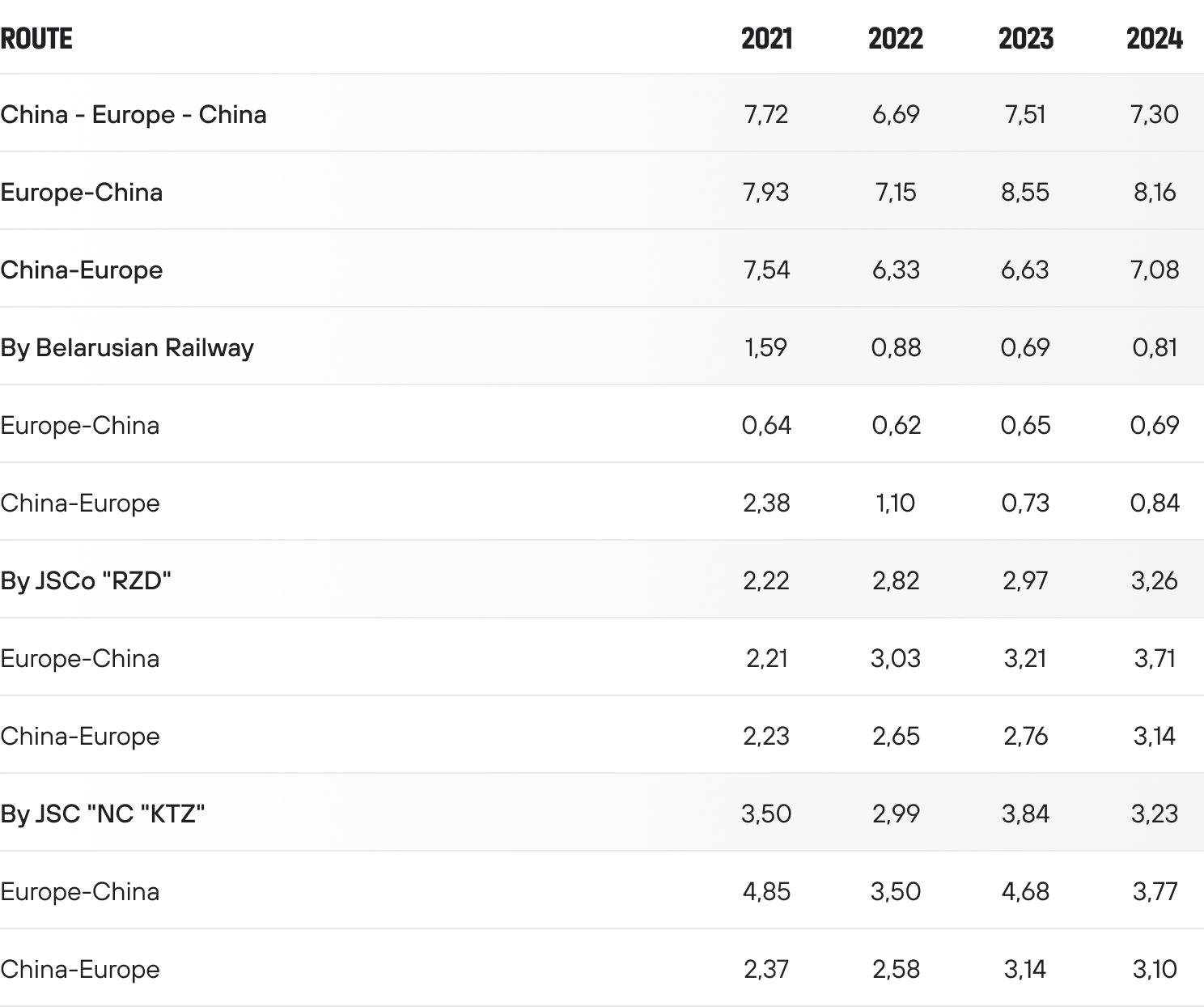

In 2024, transit trains operating on the 1520 mm gauge maintained an average route speed of 746 kilometers per day. At the end of 2024, the average journey time amounted to 7.08 days for traffic from China to the EU and 8.16 days for traffic from the EU to China. The overall average transit time was 7.3 days (with 3.23 days on JSC "NC "KTZ", 3.26 days on JSCo "RZD", and 0.81 days on the Belarusian Railway).

7.08

days

for traffic from China to the EU

8.16

days

for traffic from the EU to China

Average route speed of transit trains in the UTLC ERA service, km/day

Average transit time of container block trains in the UTLC ERA service, days

Trends in the deployment of XL train technology

3.3

Customer service development

2024 Client Portfolio

17

companies

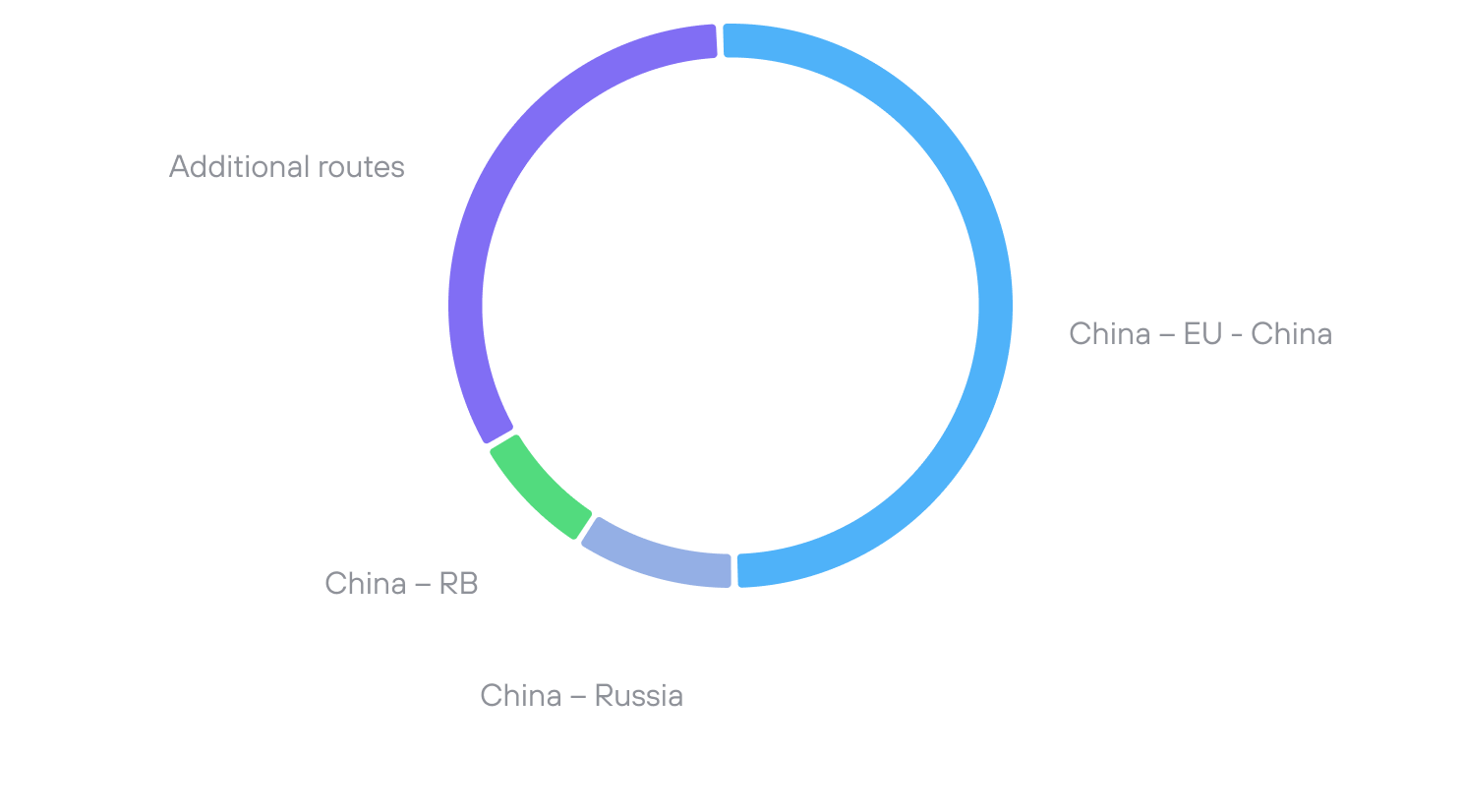

Was involved in During the reporting year, transit container traffic on the China‑Europe‑China and China‑Russia/Belarus routes

514,414

TEU

The total volume by routes China‑Europe‑China, China‑Russia/Belarus

69% of all transit shipments in 2024

380,648

TEU

The volume of transportation China‑Europe‑China

51% of the total volume handled by UTLC ERA

Despite the decline in shipments from Europe, driven by the overall economic situation, sanctions restrictions, and lower sea freight rates, the Company succeeded not only in retaining its key customers on the core transit route, but also significantly increased transportation volumes on the China–Europe corridor.

Rising shipments on the China–Europe corridor came at the expense of the China–Russia route, as some of the volume was redirected. Nevertheless, the service continues to play

a key role for UTLC ERA

330,896

TEU

volume of shipments on the China–Europe route

11

Companies

of the Company’s clients relied on it for their shipments of the China‑Russia route

The total transportation volume amounted to 78,470 TEU

In 2024, the service from China to Belarus via Kazakhstan continued to develop. Currently, it has become one of the leading overland corridors connecting China and Belarus.

10

companies

of the Company’s clients relied on it for their shipments of the China‑Belarus route

handling a total of 55,296 TEU

Share of UTLC ERA’s transportation by routes,

%

Customer communications

The year 2024 saw major developments that shaped container shipping across UTLC ERA’s service lines. The company puts customers first, prioritizing involvement in their business, timely responses to their questions and challenges, and finding solutions together. In 2024, our client service improved its communication with customers and partners.

Previously, following its operations, the Company sent out informational reports about its activities. These reports presented the main results of our work, the challenges the company faced during certain periods, and trends in the container transportation market. This approach helps the Company to foster greater transparency with clients and partners, highlighting essential aspects of transportation and providing additional information for a better understanding of the logistics market.

In 2024, in line with global trends in customer engagement, UTLC ERA continued its project of preparing interactive annual reports for clients. These reports allow clients to look at their operational activities from a new perspective and focus on key indicators.

feedback

Each visitor can also rate UTLC ERA’s 2024 performance and answer questions about the company’s operations. This user-friendly approach makes it easy to gather client feedback and collect information for deeper analysis.

4.94

out of 5

clients rated UTLC ERA’s service quality

at an average of

For partners from China

Understanding how crucial it is to keep Chinese partners updated, in 2024 UTLC ERA created five customized web pages for the major rail logistics hubs in Xi’an, Chengdu, Wuhan, Zhengzhou, and Chongqing.

Furthermore, the company delivered essential performance metrics and analytics, specially adapted to each platform and its operational specifics. The pages were translated into Chinese with the use of industry-specific terminology.

To ensure accessibility for Chinese clients, dedicated hosting was used that takes local internet restrictions into account. Reports like these further develop UTLC ERA’s partnerships with large logistics platforms, fostering closer communication and serving as a reminder of the company’s importance in rail freight between China and Europe.

Container shipments at stations of the Moscow Railway

3,008

TEU

a combined volume from April to December 2024 operated within this service

In April 2024, UTLC ERA introduced a new service for clients: transporting goods from European countries to destinations on the Moscow Railway. By integrating these shipments into the overall balance of China‑Europe cargo flows, they became more attractive for clients involved in China‑Europe‑China transit operations. By dispatching container block trains from Europe, customers were able to improve their balance indicators and continue operating under special rates.

A further advantage for the Company was the efficient utilization of empty railcars arising at the Belarus‑Poland border after the unloading of China-bound trains. From April to December 2024, a total of 25 container block trains operated within this service, transporting a combined volume of 3,008 TEU. The Selyatino, Silikatnaya, and Ramenskoye station terminals were involved in operations at the Moscow railway hub. Key cargo types consisted of washing machines, built-in ovens, and other everyday household appliances. In this way, the project brought advantages to clients — enabling more efficient cargo flow management — and to the Company itself, which not only lowered expenses associated with returning empty wagons but also established a new freight route.

3.4

Rolling stock

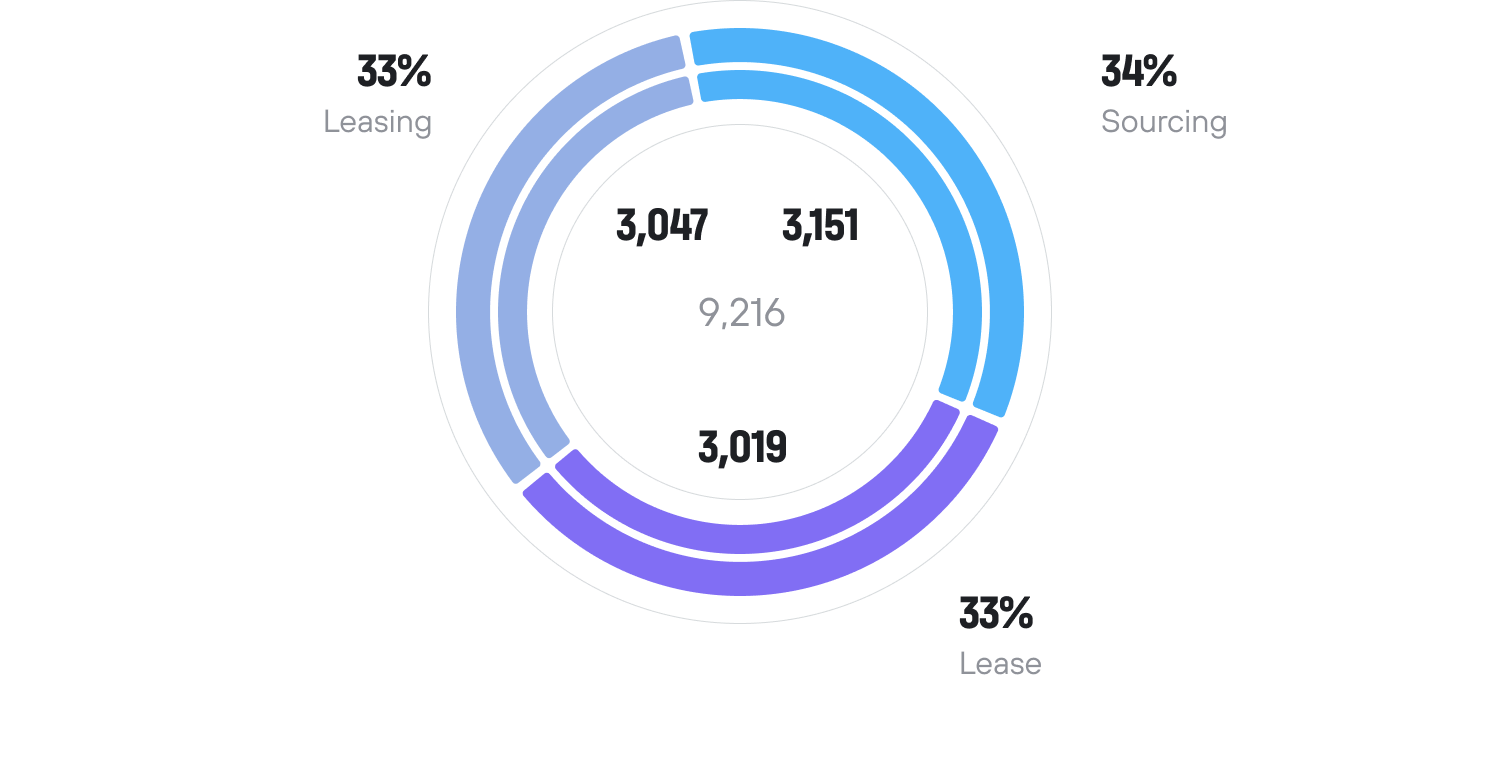

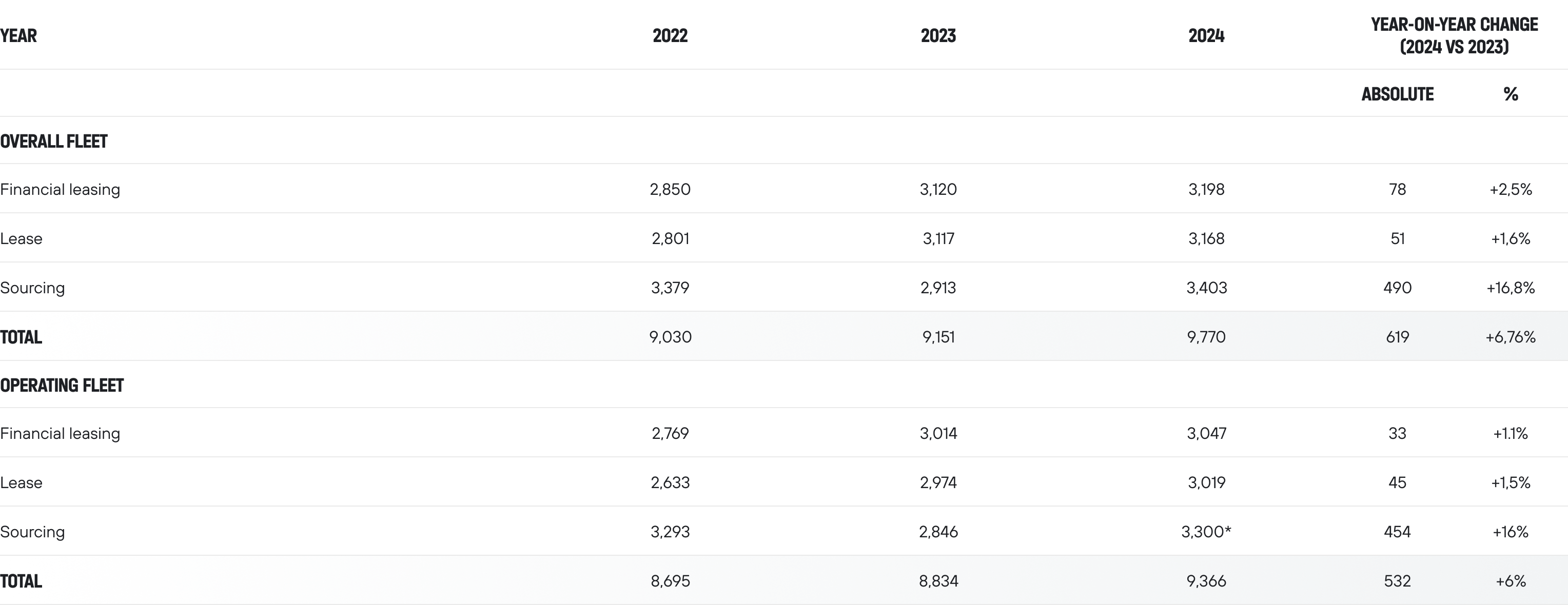

UTLC ERA’s approach to rolling stock management prioritizes efficiency and flexibility.

The fleet consists of three types,

based on ownership

-

leased

-

sourced from partners

-

those acquired under financial leasing.

Leased cars and those on financial lease serve as a stable foundation for securing transportation volumes. When transportation demand shifts, the Company responds swiftly by spot-hiring or releasing rolling stock under trip-specific agreements.

The Company’s experience with financial leasing of the fleet from 2019 to 2024 confirmed the economic advantages of this approach.

Moreover, having rail cars through financial leasing and regular leasing enables the Company to

-

ensure timely maintenance of the fleet

-

facilitate transportation that necessitates

an OKPO code in the automated data bank

of the car fleet system -

make quick decisions on the usage of rolling stock with no approval of the owner required

Another key benefit of financial leasing is stable expenses that are not influenced by market trends for rolling stock.

Optimization of fleet composition

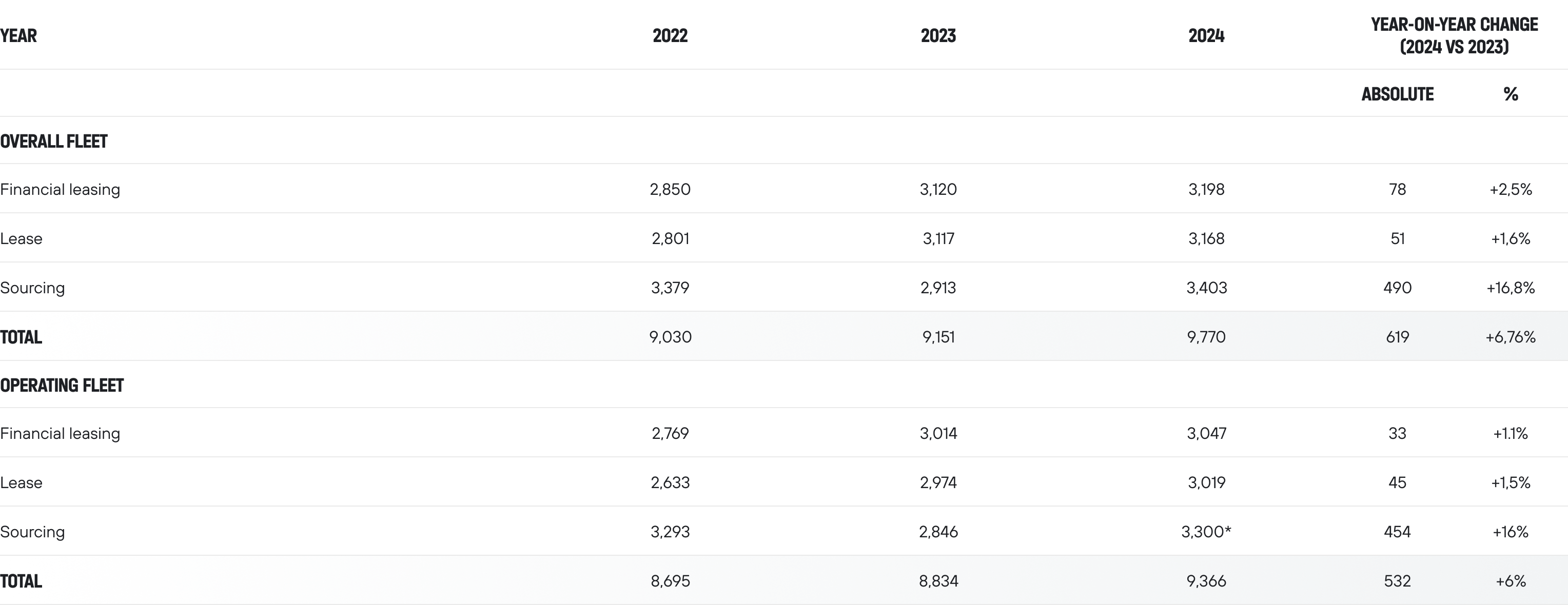

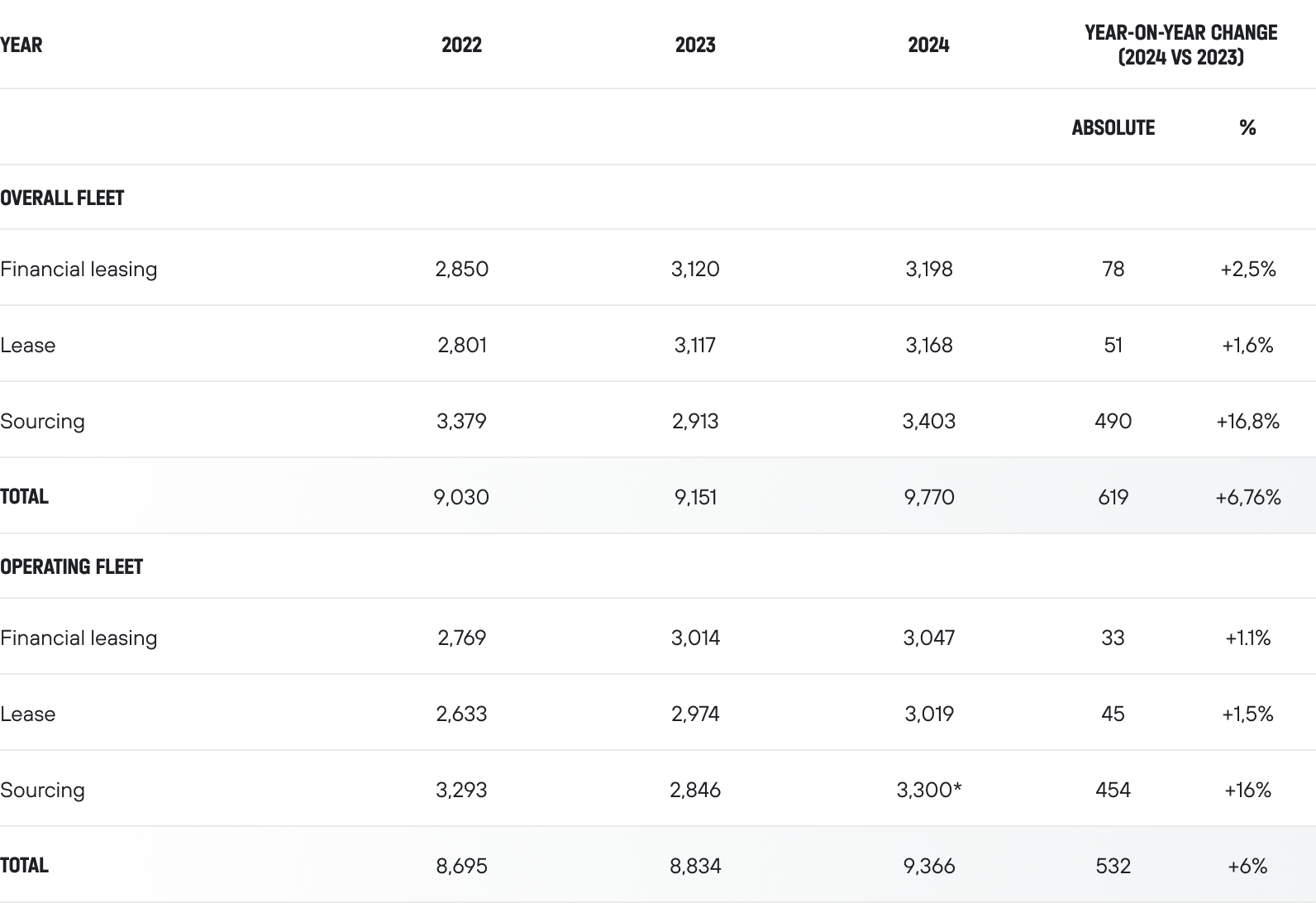

As of now, UTLC ERA has achieved an optimal structure in its railcar fleet composition, tailored to diverse sourcing strategies.

By the end of the year leased and finance-leased flatcars accounted for 66% of the fleet, ensuring UTLC ERA’s transportation assets were deployed with minimal risk and high maintenance efficiency, as well as maximum flexibility.

Breakdown of average daily operational fleet under management*,

%.

Breakdown of average daily railcar fleet,

units

*total fleet including One-Way cars

The outpacing growth in demand for transit shipments prompted adjustments to operational processes: additional railcar routes were created and existing ones modified, resulting in changes that impacted railcar turnover.

10.7%

UTLC ERA’s transportation volumes grew by

+80.3%

increase in transit traffic

The sharp rise in demand for transit shipments

While maintaining adequate rolling stock for export and import flows was addressed thanks to close collaboration with the traffic departments of all three railway administrations, particularly regarding the movement of empty trains to facilitate transit dispatches from Dostyk and Altynkol stations.

To optimize costs and fully utilize the infrastructure of Belarusian Railways and Russian Railways, the Company adopts a technology of assembling trains of empty container flatcars up to 114 nominal car lengths for selected dispatches from Brest to Dostyk and Altynkol. Throughout 2024, 43 trains were formed and dispatched under this arrangement, resulting in an average length of 71 nominal cars for UTLC ERA’s empty container flatcar trains dispatched to Dostyk and Altynkol.

71

nominal cars

an average length of 71 nominal cars for UTLC ERA’s empty container flatcar trains dispatched to Dostyk and Altynkol.

Car repair

One of the crucial production indicators in transportation organization is maintaining control over the technical condition of the car fleet, ensuring timely scheduled repairs, and minimizing the number of ongoing uncoupling repairs (TR‑2). This is measured by the frequency of uncouplings within a specific time frame.

Repair outages, units

3.5

Innovative development

Functional product overview

In 2024, UTLC ERA further advanced the development of its in-house information system by accomplishing the following:

-

accounting reserve calculations have been implemented based on supplier data, planned indicators, and internal estimates of expenses.

-

automated reports for the reconciliation of settlements have been prepared based on supplier-provided data and the Company’s internally determined estimates of major service costs. Settlement reconciliation results are automatically forwarded to accounting, utilizing expense breakdowns by cost item.

-

the first phase of the marginal profit report, based on figures computed in the information system, has been completed.

-

improvements are currently in progress for the client shipment request log and the algorithms supporting online tracking of containers and railcars.

Prospective Developments

Jointly with partners, preparations are underway for the launch of a digital portal for electronic transit declarations and for integration with the information system of the customs authorities of the Republic of Kazakhstan, to support the acceptance of containers from China along UTLC ERA service routes. Implementing this digital portal will allow for the practical realization of the Joint Board of the Customs Services of the Customs Union Resolution No. 41/14 dated April 7, 2023, while ensuring the elimination of paper-based workflow in customs transit procedures. Further activities in this field are scheduled to continue.

An essential element in the digitalization of international rail container transportation is the ability to exchange legally significant and reliable data and documents with the consignor and carrier in the country of departure.

In 2023, UTLC ERA continued actively seeking data sources, engaging in discussions with partners, and laying the groundwork for electronic data exchange in its services. The company successfully secured agreements with key partners from China to further advance in this domain.

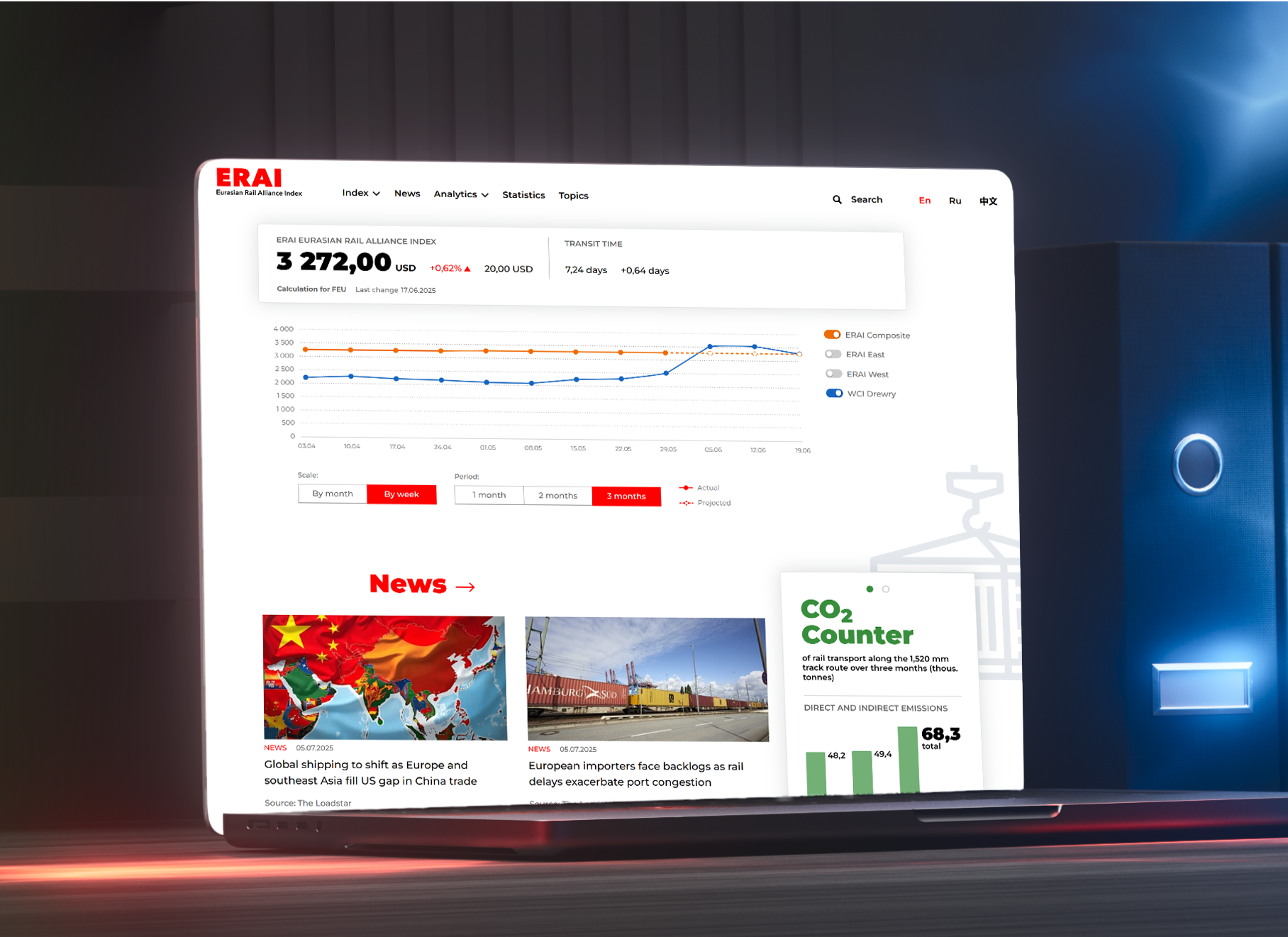

ERAI is an information and analytics portal focused on advancing Eurasian logistics and supporting international transport corridors running through the infrastructure of the Company’s shareholders.

The ERAI (Eurasian Rail Alliance Index) — is a comprehensive measure of the cost of container transit along the Eurasian railway corridor through the EAEU, for China‑EU and EU‑China services. The portal features ERAI index quotations, analytical and informational content, and, starting recently, bi-monthly monitoring reports on the Eurasian logistics market.

Further improvements to the ERAI portal are scheduled for 2025

The project's main tasks include growing audience reach, promoting the benefits of Eurasian corridors and EAEU transit, attracting customers and cargo flows, and strengthening the image of shareholders’ infrastructure as a key component of Eurasian logistics.

The ERAI portal and index are regularly cited by respected media, top consulting firms, and international logistics providers.

~250

thousand visitors

ERAI portal's traffic since 2020

~80

thousand

of visitors in 2024

+12.3%3.6

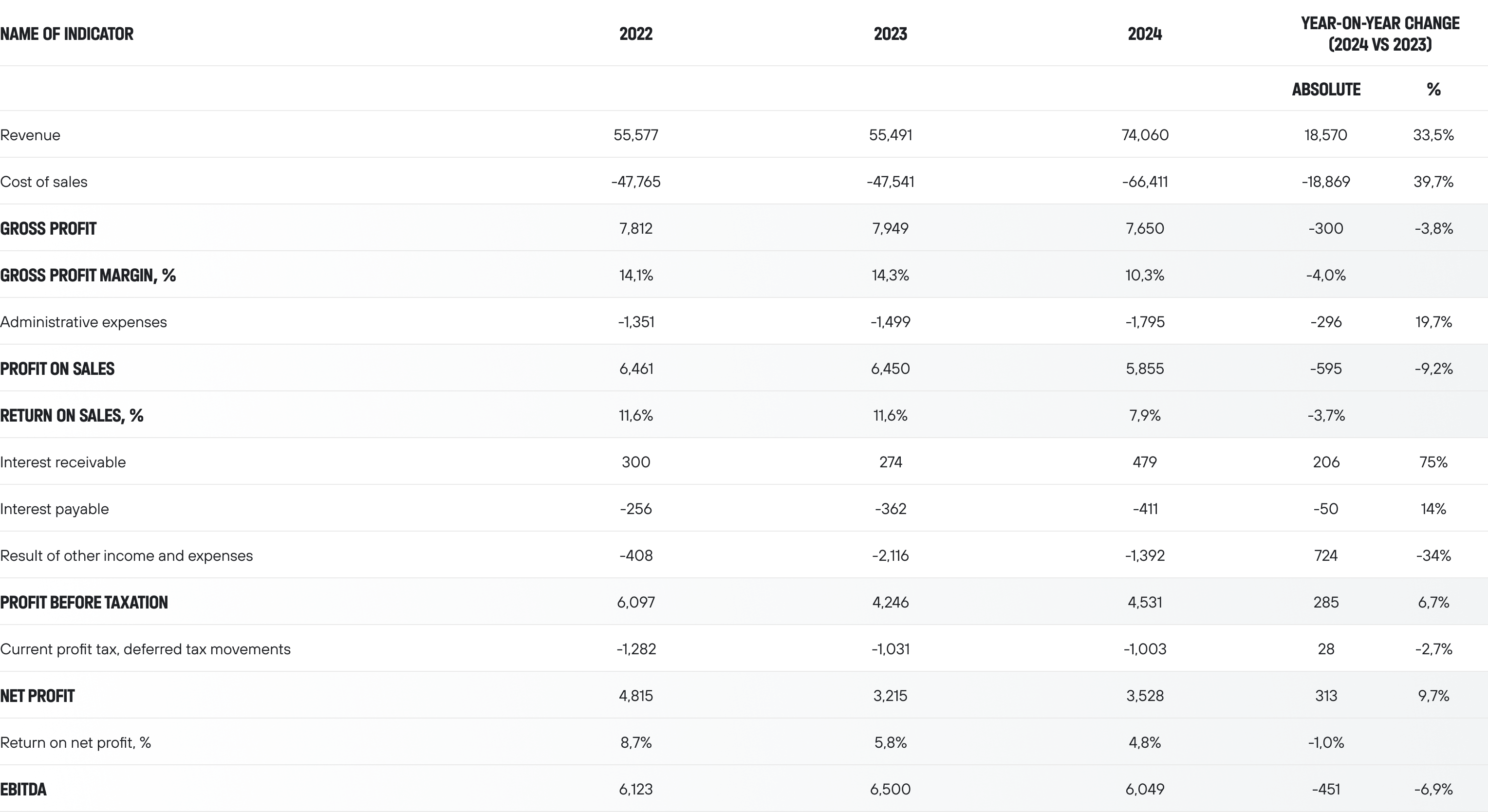

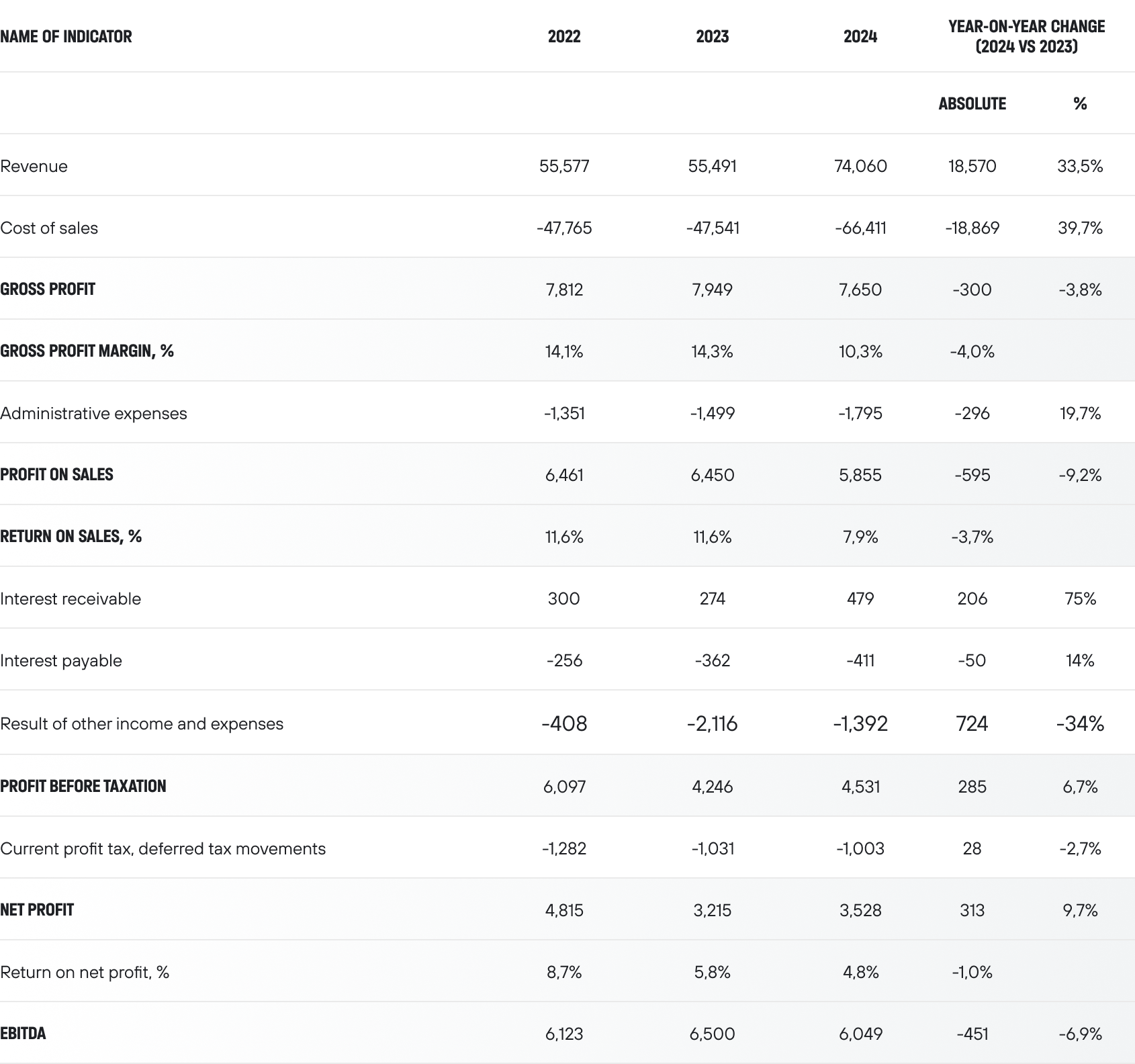

Financial Review

In 2024, shifts in the global economy kept impacting Eurasian trade.

Relatively low customer demand in Europe and China, a downturn in industrial production within the European Union, and ongoing geopolitical tensions presented new challenges for the transport and logistics industry. Despite these challenges, the recovery of transit traffic on the China‑Europe route emerged as a key trend in 2024. Rising shipment volumes strengthened the Company’s financial performance.

Revenue

74,060

million RUB

UTLC ERA Revenue for 2024

for 2022–2024, million RUB

cost of sales

66,411

million RUB

UTLC ERA’s cost of sales for 2024

The increase in revenue was primarily due to higher transportation volumes, a shift in volumes towards a greater share of transit shipments — which have higher rates than export and import shipments — and an 8.7% increase in the average annual US dollar exchange rate in 2024 compared to 2023 (2024: 92.5664 RUB; 2023: 85.1758 RUB).

The higher pace of cost growth relative to revenue can be attributed primarily to the following drivers:

-

An uptick in infrastructure tariffs driven

by the growing share of transit traffic -

The 2024 adjustment of non-transit infrastructure rates

-

Appreciation of currencies used for expense payments

-

Reduced cargo flow balancing compared to 2023 driving up empty rail car repositioning expenses

-

Rising fleet management costs driven by increased market rates for fleet sourcing;

The dynamics of key financial indicators for the 2022–2024, million RUB

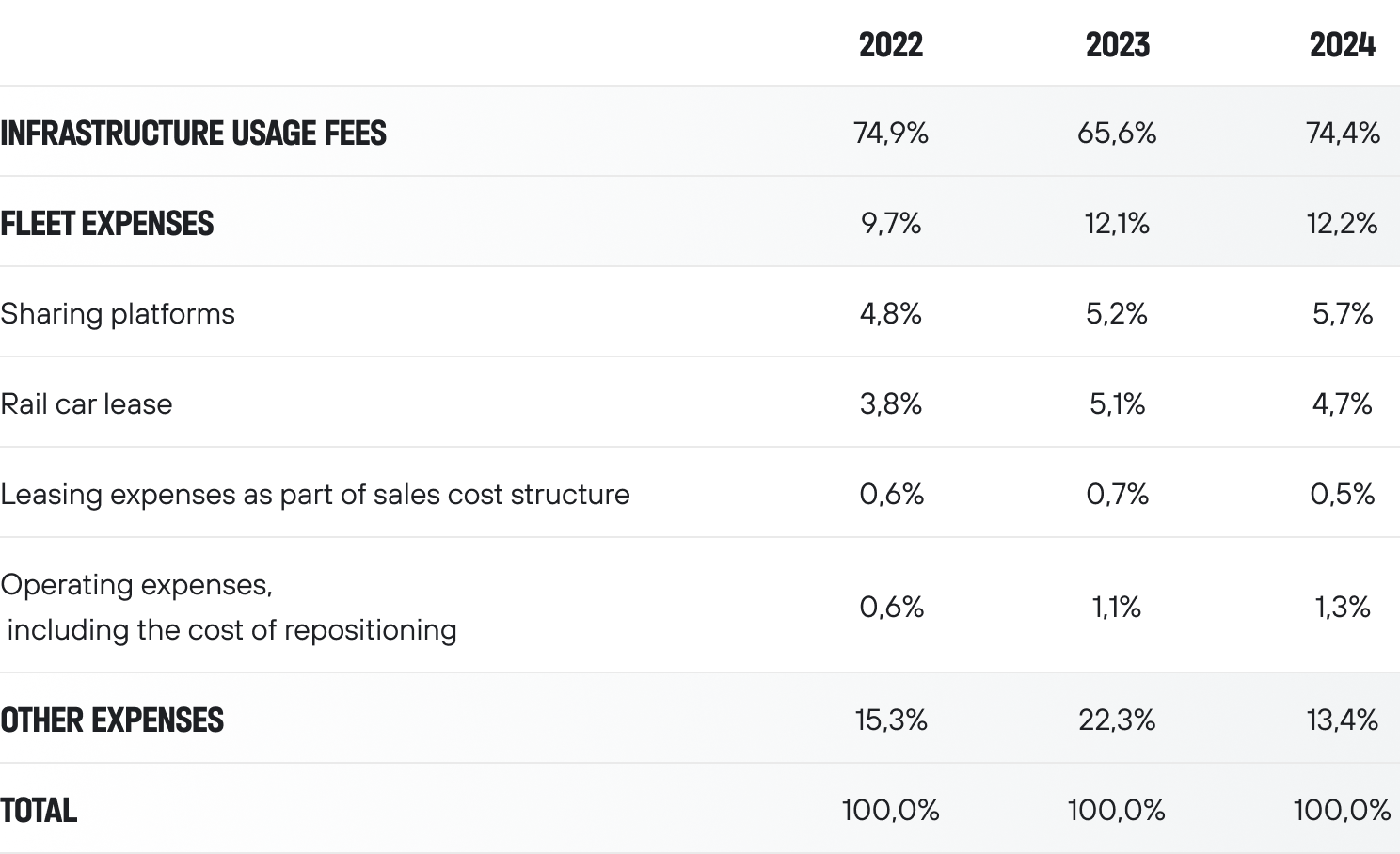

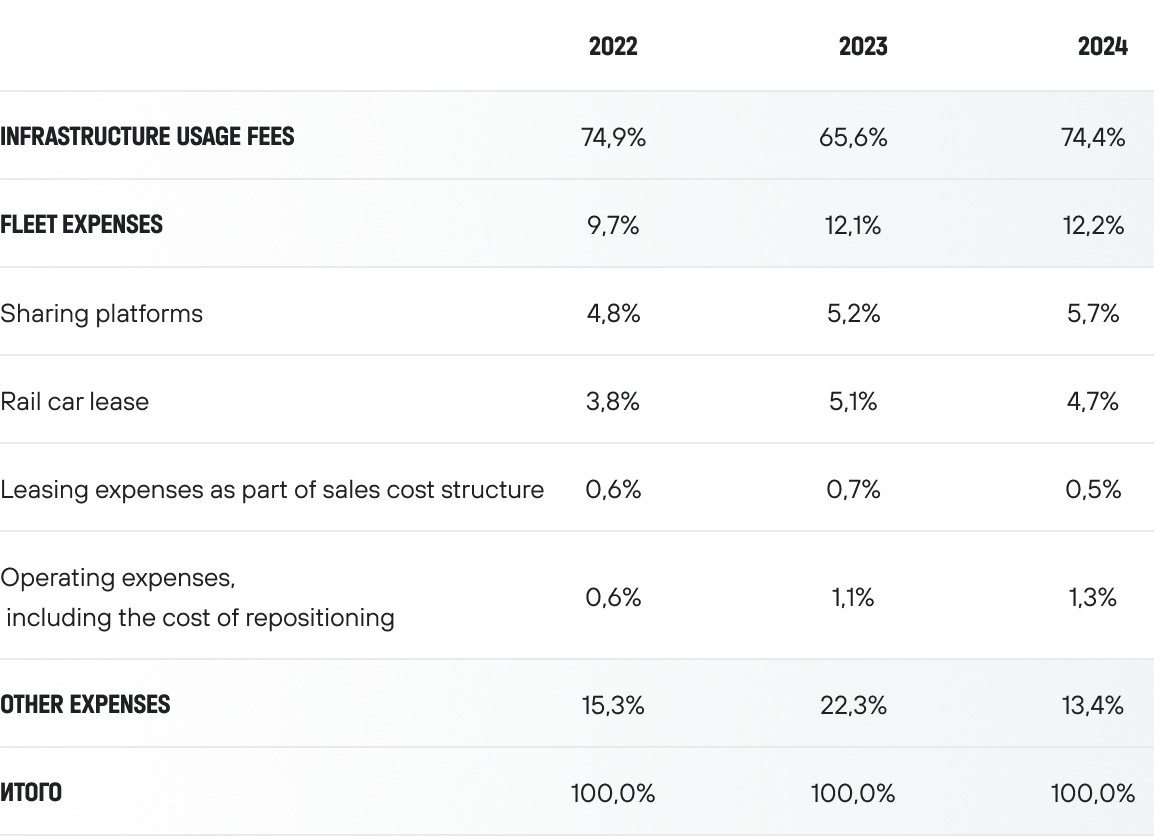

Sales cost structure

72.7%

Infrastructure usage feels

JSCo «RZD»

LLP «KTZ-SE»

Belorussian Railway

Other counterparties

Fleet expenses

Other expenses

Trends in the breakdown of cost of sales, %

In 2024, infrastructure usage fees paid to shareholders surged by 56% year-on-year, primarily as a result of higher transportation volumes, a larger proportion of transit shipments, tariff indexation, currency fluctuations, and increased empty mileage stemming from lower operational balancing.

Another significant expense, representing 12.2% of the cost of sales, is attributed to the fleet under management. This includes expenses for their operation and the depreciation of the "Right of Use" assets (platforms under financial lease agreements). Since mid-2019, the Company has been ramping up its share of both operating and finance-leased platforms. As of the end of 2024, leased platforms comprised 38% and finance-leased platforms 32% of the operating fleet.

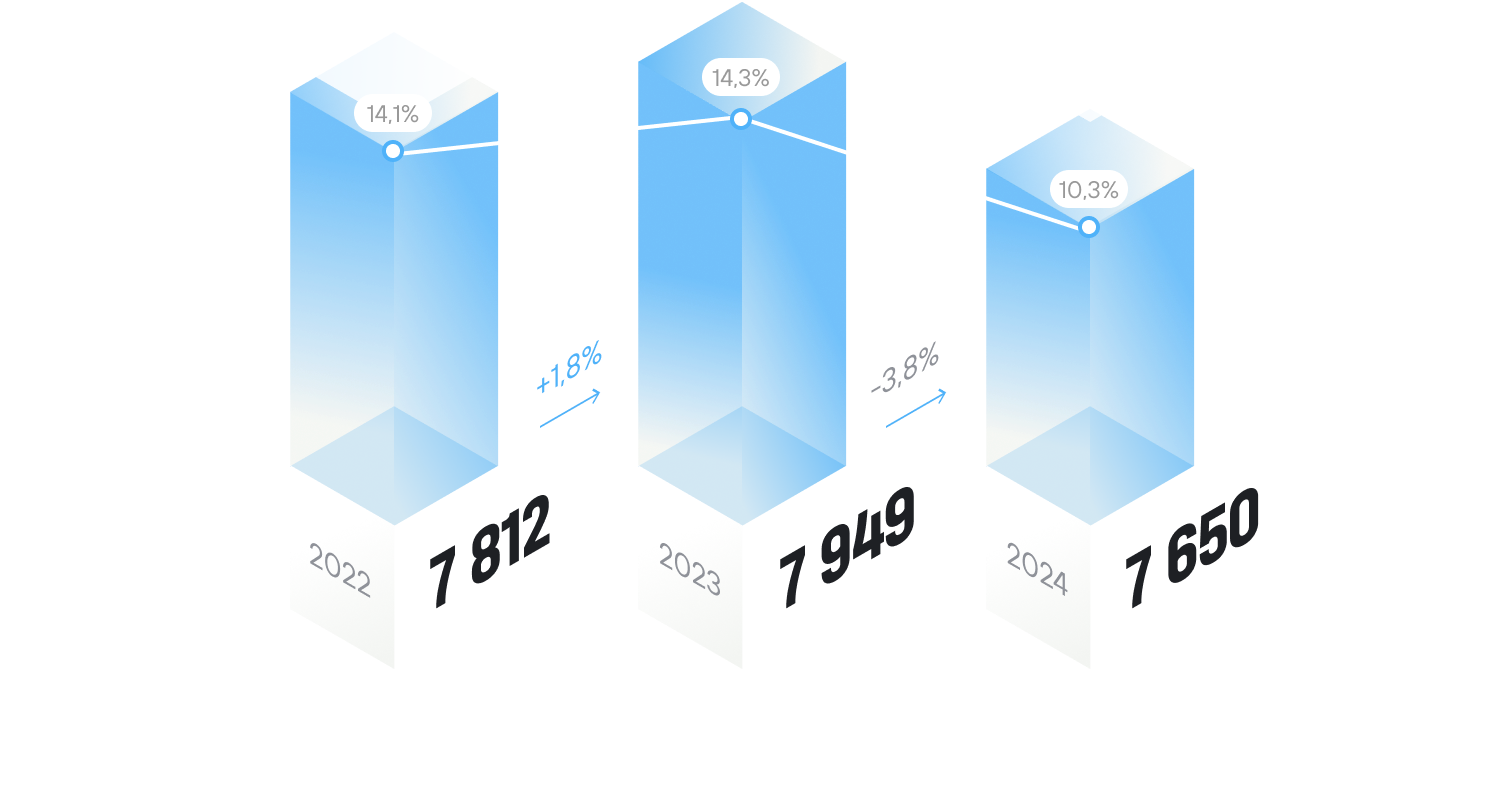

gross profit

7,650

million RUB

million RUB

for 2022–2024, million RUB

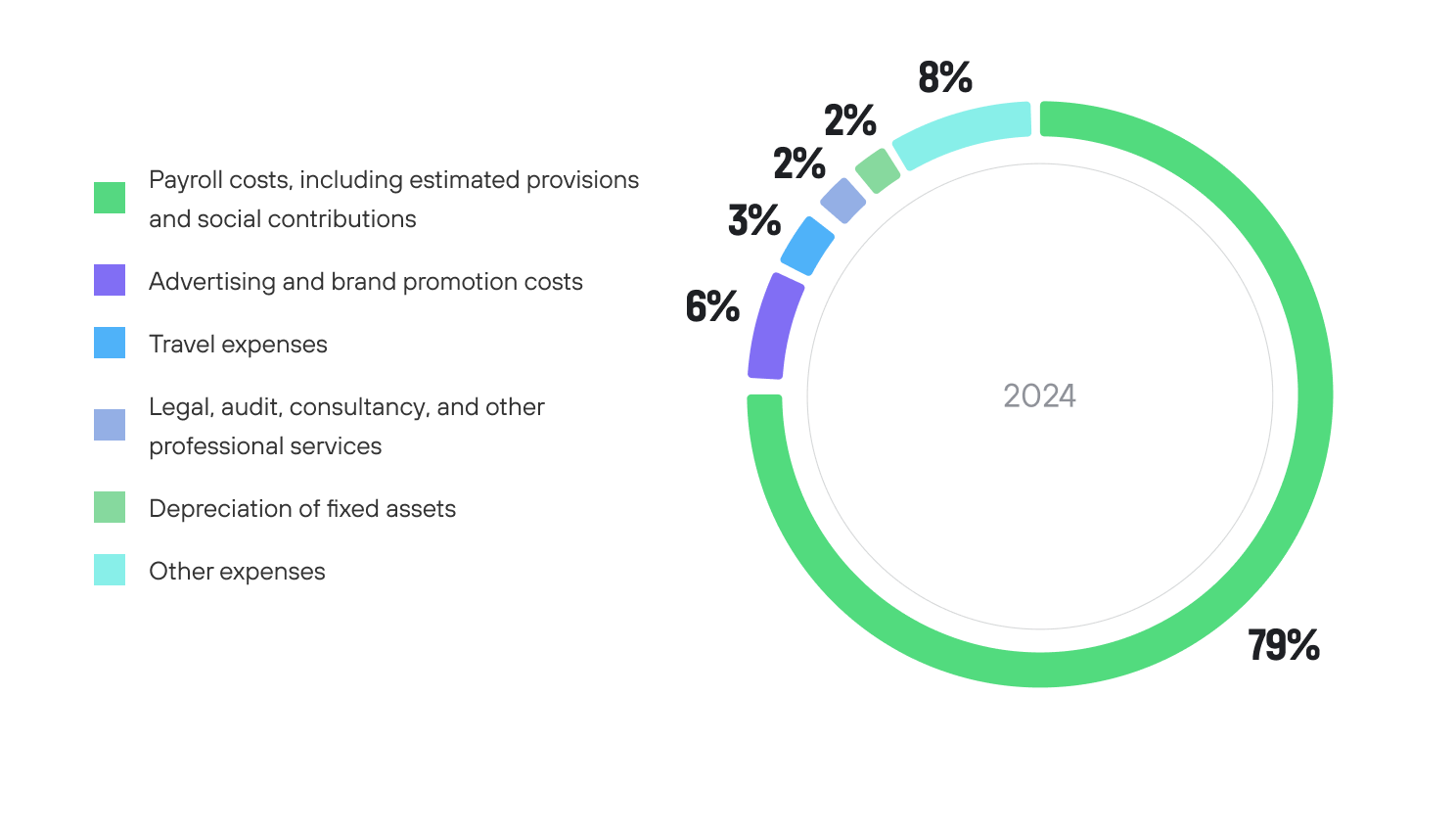

Administrative expenses

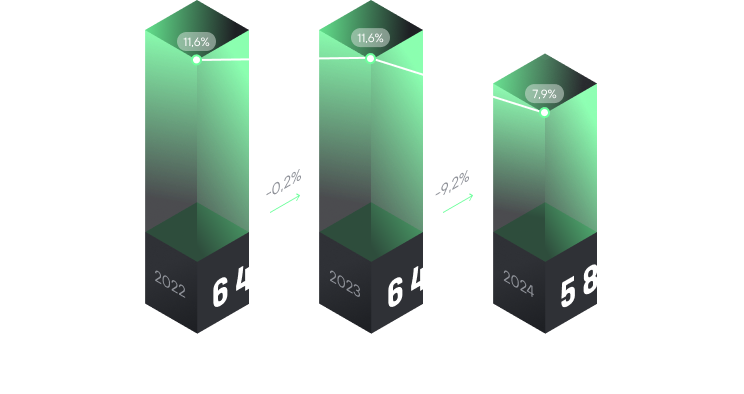

UTLC ERA administrative expenses 2022–2024,

million RUB

The year-on-year rise in administrative expenses was mainly attributable to rising personnel costs, accrual of estimated liabilities, and social security contributions, driven by growth in average headcount, indexation of the payroll fund, targeted salary adjustments, and staff turnover during the year.

Breakdown of administrative expenses, %

EBITDA

6,049

million RUB

EBITDA for 2024

Profit on sales

5,855

million RUB

sales profit for 2024

net profit

3 528

RUB million

net profit for 2024